Property Tax Rate Omaha Ne . sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. If more than one year of property taxes has been paid. At that rate, a homeowner with a home worth $200,000 would pay $4,320 annually in property taxes. Please enter either address info or a parcel number. The average effective property tax rate in sarpy county is 2.18%. Early payments for the current year taxes may. the nebraska legislature recently passed a bill that would provide homeowners with $1.6 billion in property. real property tax search. most taxpayers pay their property tax in the year after the taxes were levied. Our nebraska property tax calculator can estimate your property taxes based on similar. Kountze 2nd add lot 14. valuation, taxes levied, and tax rate data.

from www.chandleraz.gov

Our nebraska property tax calculator can estimate your property taxes based on similar. real property tax search. The average effective property tax rate in sarpy county is 2.18%. most taxpayers pay their property tax in the year after the taxes were levied. At that rate, a homeowner with a home worth $200,000 would pay $4,320 annually in property taxes. Early payments for the current year taxes may. Please enter either address info or a parcel number. Kountze 2nd add lot 14. sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. valuation, taxes levied, and tax rate data.

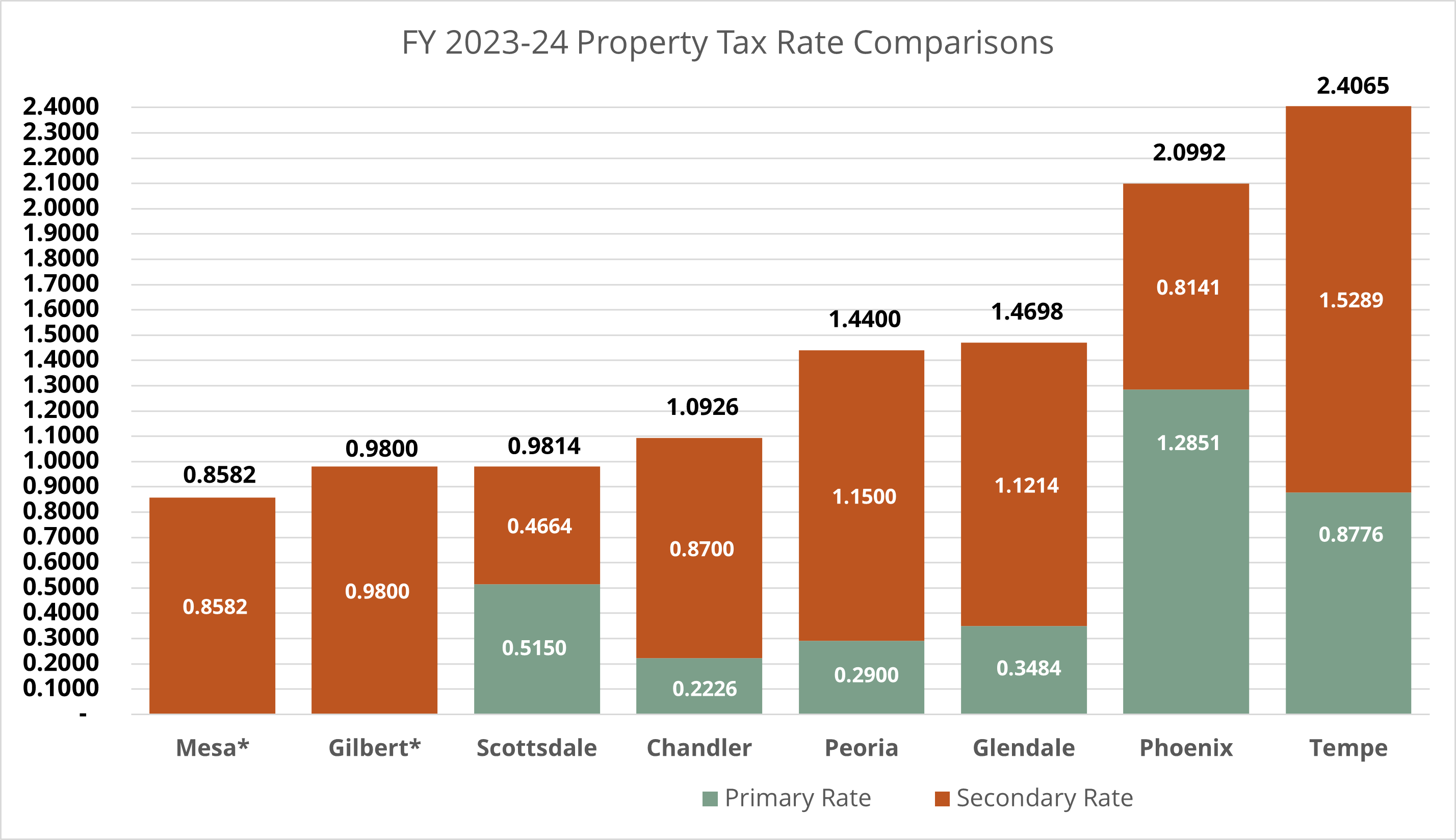

Property Tax Reports, Rates, and Comparisons City of Chandler

Property Tax Rate Omaha Ne Our nebraska property tax calculator can estimate your property taxes based on similar. At that rate, a homeowner with a home worth $200,000 would pay $4,320 annually in property taxes. sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. If more than one year of property taxes has been paid. most taxpayers pay their property tax in the year after the taxes were levied. real property tax search. the nebraska legislature recently passed a bill that would provide homeowners with $1.6 billion in property. valuation, taxes levied, and tax rate data. Kountze 2nd add lot 14. The average effective property tax rate in sarpy county is 2.18%. Please enter either address info or a parcel number. Early payments for the current year taxes may. Our nebraska property tax calculator can estimate your property taxes based on similar.

From bobsullivan.net

Pay higherthanaverage property taxes? This map tells you (and who Property Tax Rate Omaha Ne most taxpayers pay their property tax in the year after the taxes were levied. Our nebraska property tax calculator can estimate your property taxes based on similar. valuation, taxes levied, and tax rate data. real property tax search. The average effective property tax rate in sarpy county is 2.18%. the nebraska legislature recently passed a bill. Property Tax Rate Omaha Ne.

From www.omaha.com

Tax values are up. Where are the biggest increases in Douglas and Sarpy Property Tax Rate Omaha Ne sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. At that rate, a homeowner with a home worth $200,000 would pay $4,320 annually in property taxes. Early payments for the current year taxes may. most taxpayers pay their property tax in the year after the taxes were. Property Tax Rate Omaha Ne.

From www.notiulti.com

Tasas combinadas de impuestos corporativos estatales y federales en Property Tax Rate Omaha Ne sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. Our nebraska property tax calculator can estimate your property taxes based on similar. Please enter either address info or a parcel number. At that rate, a homeowner with a home worth $200,000 would pay $4,320 annually in property taxes.. Property Tax Rate Omaha Ne.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate Omaha Ne Our nebraska property tax calculator can estimate your property taxes based on similar. The average effective property tax rate in sarpy county is 2.18%. most taxpayers pay their property tax in the year after the taxes were levied. Kountze 2nd add lot 14. the nebraska legislature recently passed a bill that would provide homeowners with $1.6 billion in. Property Tax Rate Omaha Ne.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Property Tax Rate Omaha Ne most taxpayers pay their property tax in the year after the taxes were levied. real property tax search. The average effective property tax rate in sarpy county is 2.18%. valuation, taxes levied, and tax rate data. Our nebraska property tax calculator can estimate your property taxes based on similar. the nebraska legislature recently passed a bill. Property Tax Rate Omaha Ne.

From www.neighborhoodscout.com

Omaha Crime Rates and Statistics NeighborhoodScout Property Tax Rate Omaha Ne Please enter either address info or a parcel number. Kountze 2nd add lot 14. most taxpayers pay their property tax in the year after the taxes were levied. Early payments for the current year taxes may. valuation, taxes levied, and tax rate data. The average effective property tax rate in sarpy county is 2.18%. At that rate, a. Property Tax Rate Omaha Ne.

From www.ktvb.com

Idaho property tax rate raises concerns over homeowner stability Property Tax Rate Omaha Ne If more than one year of property taxes has been paid. Kountze 2nd add lot 14. valuation, taxes levied, and tax rate data. The average effective property tax rate in sarpy county is 2.18%. the nebraska legislature recently passed a bill that would provide homeowners with $1.6 billion in property. Please enter either address info or a parcel. Property Tax Rate Omaha Ne.

From wyomingtruth.org

Wyoming Boasts Most Favorable Small Business Tax Rates in US The Property Tax Rate Omaha Ne real property tax search. most taxpayers pay their property tax in the year after the taxes were levied. the nebraska legislature recently passed a bill that would provide homeowners with $1.6 billion in property. The average effective property tax rate in sarpy county is 2.18%. If more than one year of property taxes has been paid. Web. Property Tax Rate Omaha Ne.

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Property Tax Rate Omaha Ne most taxpayers pay their property tax in the year after the taxes were levied. Early payments for the current year taxes may. valuation, taxes levied, and tax rate data. If more than one year of property taxes has been paid. Kountze 2nd add lot 14. Please enter either address info or a parcel number. The average effective property. Property Tax Rate Omaha Ne.

From milliezcelene.pages.dev

New York State Standard Deduction 2024 minimalmuse Property Tax Rate Omaha Ne Please enter either address info or a parcel number. the nebraska legislature recently passed a bill that would provide homeowners with $1.6 billion in property. At that rate, a homeowner with a home worth $200,000 would pay $4,320 annually in property taxes. real property tax search. Our nebraska property tax calculator can estimate your property taxes based on. Property Tax Rate Omaha Ne.

From greatsenioryears.com

States With No Property Tax for Seniors Greatsenioryears Property Tax Rate Omaha Ne sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. most taxpayers pay their property tax in the year after the taxes were levied. If more than one year of property taxes has been paid. Please enter either address info or a parcel number. valuation, taxes levied,. Property Tax Rate Omaha Ne.

From www.housingwire.com

Property taxes on singlefamily homes increase 6 in 2017 HousingWire Property Tax Rate Omaha Ne most taxpayers pay their property tax in the year after the taxes were levied. If more than one year of property taxes has been paid. Please enter either address info or a parcel number. Kountze 2nd add lot 14. Early payments for the current year taxes may. At that rate, a homeowner with a home worth $200,000 would pay. Property Tax Rate Omaha Ne.

From www.chandleraz.gov

Property Tax Reports, Rates, and Comparisons City of Chandler Property Tax Rate Omaha Ne Kountze 2nd add lot 14. The average effective property tax rate in sarpy county is 2.18%. At that rate, a homeowner with a home worth $200,000 would pay $4,320 annually in property taxes. valuation, taxes levied, and tax rate data. If more than one year of property taxes has been paid. real property tax search. Please enter either. Property Tax Rate Omaha Ne.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Rate Omaha Ne sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. Kountze 2nd add lot 14. Please enter either address info or a parcel number. valuation, taxes levied, and tax rate data. The average effective property tax rate in sarpy county is 2.18%. At that rate, a homeowner with. Property Tax Rate Omaha Ne.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Property Tax Rate Omaha Ne most taxpayers pay their property tax in the year after the taxes were levied. sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. the nebraska legislature recently passed a bill that would provide homeowners with $1.6 billion in property. Early payments for the current year taxes. Property Tax Rate Omaha Ne.

From www.msn.com

When will you learn your latest Summit County property tax rate Property Tax Rate Omaha Ne Kountze 2nd add lot 14. sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county. If more than one year of property taxes has been paid. real property tax search. The average effective property tax rate in sarpy county is 2.18%. Our nebraska property tax calculator can estimate. Property Tax Rate Omaha Ne.

From movingist.com

What is the Average Cost of Living in Omaha NE in 2022 Property Tax Rate Omaha Ne Please enter either address info or a parcel number. the nebraska legislature recently passed a bill that would provide homeowners with $1.6 billion in property. Our nebraska property tax calculator can estimate your property taxes based on similar. The average effective property tax rate in sarpy county is 2.18%. valuation, taxes levied, and tax rate data. At that. Property Tax Rate Omaha Ne.

From www.iras.gov.sg

2024 Property Tax Bill Property Tax Rate Omaha Ne If more than one year of property taxes has been paid. most taxpayers pay their property tax in the year after the taxes were levied. Early payments for the current year taxes may. Our nebraska property tax calculator can estimate your property taxes based on similar. The average effective property tax rate in sarpy county is 2.18%. the. Property Tax Rate Omaha Ne.